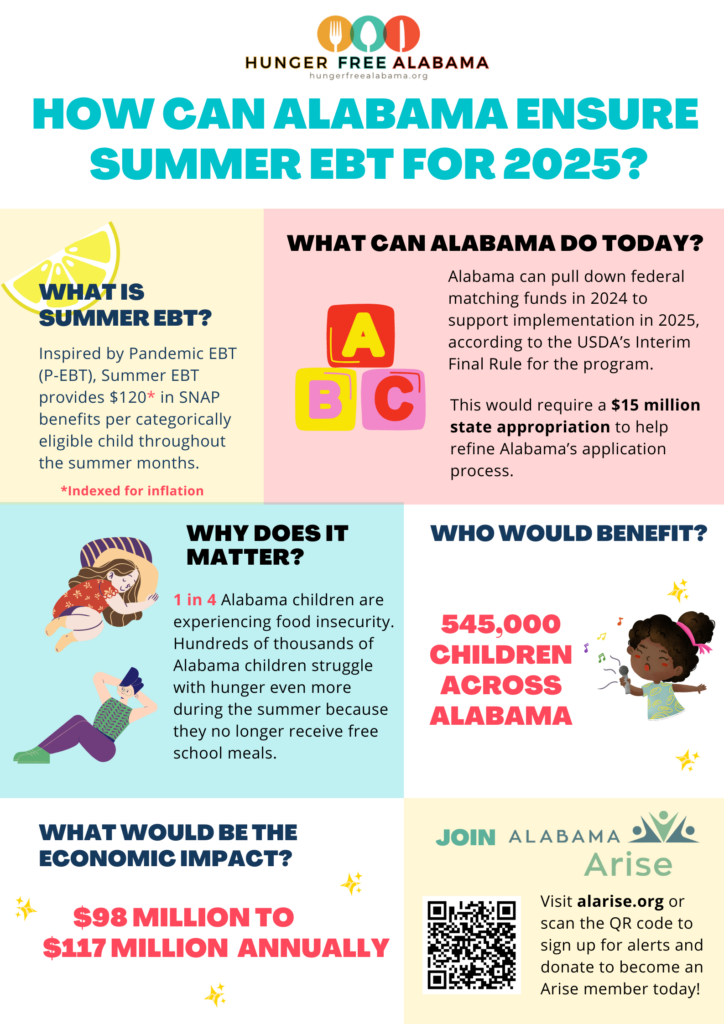

A $15 million appropriation for Summer EBT would reduce hunger by providing eligible Alabama children $40 per summer month for food.

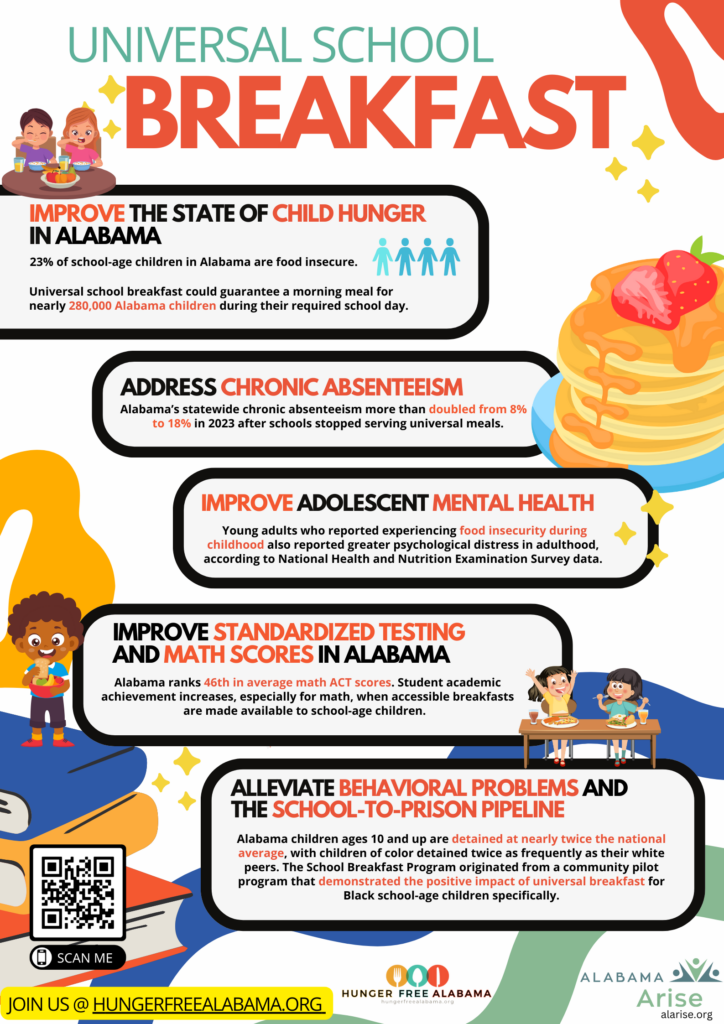

1 in 4 Alabama children are food insecure.

Hundreds of thousands of Alabama children don’t know where their next meal will come from. And a disproportionate amount of food insecure children come from communities of color. The Summer EBT program has been shown to help alleviate this problem by reducing hunger and supporting healthier diets among children.

545,000 Alabama children will miss meals this summer.

Providing funding for Summer EBT would ensure that hundreds of thousands of Alabama children don’t have to go hungry next summer. In recent years, 94% of Alabama’s children who received free or reduced-price school meals during the school year did not have access to these meals over the summer.

Summer EBT could spur around $100 million in economic activity.

This program would require an initial appropriation of $15 million yet will deliver a substantially higher return on investment. This appropriation could come from either the Education Trust Fund or the General Fund. Also worth noting: The costs of operating this program would decrease in future years.

Call center* – $5 – 8 million

EBT cost* – $4 – 5 million

DHR expenses* – $500,000

Application administration** – $9.5 – 15.5 million (website design, interface, hearings, QC, notices)

Department of Education expenses* – $1 million

Total = maximum of $30 million

State share = 50% | maximum of $15 million

* Cost estimates are based on Alabama’s experience with similar characteristics of Summer P-EBT cost from 2020-2024

** Cost estimates are based on new criteria in Summer EBT rules and similar vendor cost provided from other states participating in 2024

Summer EBT key points:

- Summer EBT (Electronic Benefits Transfer) provides eligible children $40 per summer month ($120 total).

- 1 in 4 Alabama children are food insecure, with a disproportionate amount coming from households of color.

- 94% of Alabama children who receive free or reduced-price meals do not have access to them over the summer.

- Summer EBT is a $15 million state investment in child nutrition, with a $1 for $1 federal match, that could spur around $100 million in economic activity annually across Alabama.

- The Summer EBT program could reduce hunger and support healthier diets for more than half a million (545,000) Alabama children.