It’s a truism often heard during budget hearings at the Alabama State House: “All the growth taxes go to education.” Legislators commonly say this to bemoan relatively flat revenue for the General Fund (GF), even when the economy is booming. Meanwhile, the Education Trust Fund (ETF) budget grows by comparative leaps and bounds.

There is a downside, however, to how quickly the ETF responds to economic conditions. Education revenue can decline quickly and sharply during hard economic times. And that’s the situation we’re in now, thanks to the COVID-19 recession.

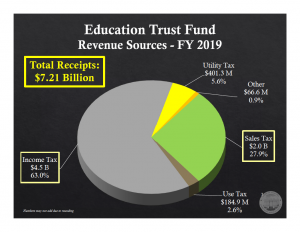

The ETF gets nearly all its money from two major sources. One is income taxes, which are constitutionally earmarked for teacher salaries. The other is sales and use taxes. (Use taxes apply to online and mail-order purchases.) Income taxes account for 63% of state money going to Alabama schools, and sales and use taxes contribute another 30%.

During a strong economy, this is a very good thing for education. Income taxes can grow quickly when more people are working, and sales taxes grow quickly when they spend those earnings. During bad economic times and high unemployment, however, both income and sales taxes suffer. And right now the economic times are some of the worst that Alabamians have ever seen.

ETF revenues plummet as the pandemic hits Alabama

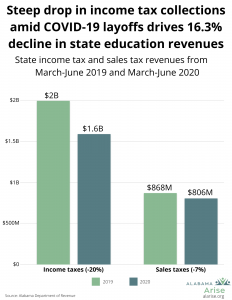

Because of the pandemic and the recession that resulted, Alabama’s unemployment rate shot up from a near-record low of 3% in March to a near-record high of 12.9% in April. Income taxes responded in kind, dropping more than 50% between March and April 2020. May and June’s revenues recovered somewhat but were still more than 12% lower than income tax revenues for the same period in 2019. Altogether, income tax collections from March through June were down more than 20% compared to 2019.

Sales taxes went down, too, though not as dramatically as income taxes. Sales tax collections from March through June were down slightly more than 7% compared to 2019. Overall, income and sales tax revenues during those months were down 16.3% compared to the same period last year.

Despite those declines, the Alabama Legislature passed a 2021 education budget that is larger than this year’s. Both legislators and the governor have expressed confidence that reserve and Rainy Day accounts will be enough to avoid automatic spending cuts known as proration this year and next, even if the economy is slow to recover.

Warning signs on the horizon for the ETF

But ETF revenue trends in recent months have been troubling. Education revenue increased by 8% between October and February, according to a budget presentation that Kirk Fulford, deputy director of the Legislative Services Agency (LSA) Fiscal Division, gave before a Senate budget committee on July 9. When the recession hit between March and June, however, revenues fell 17% compared to the same period in 2019. That reduced total ETF revenue growth fiscal year (FY) 2020 to barely 1%. (Alabama’s fiscal years run from Oct. 1 to Sept. 30.)

By contrast, the news was better for the GF, which funds Medicaid, corrections and other non-education services. Revenue growth remained at a relatively healthy 7% compared to last year. The GF benefited in large part from an earmarked internet sales tax (called the “simplified sellers use tax”) that increased by $16 million from March to June. That growth came on top of a $34 million increase earlier in the fiscal year.

Fulford remained optimistic that neither budget would face proration in 2020, despite worrisome ETF revenue projections. He reassured legislators that healthy beginning balances, debt reduction and savings accounts created under the Rolling Reserve Act would protect the ETF at least through FY 2020.

Alabama Arise trusts the LSA’s expertise but remains concerned, especially about 2021. Our state’s tax system simply may not bring in enough money to fund our schools if the pandemic recession is long or deeper than anticipated.

Better tax policies for a brighter future

Alabama’s experience during the Great Recession a decade ago proves the need for caution. More than a dozen years later, Alabama’s education funding still hasn’t returned to its pre-recession level. And if revenues decline at the same rate as in 2009, the ETF could lose $841 million in state money next year. That would be the equivalent of one-fifth of all state K-12 funding.

It’s not enough to cross our fingers and just hope the economy and revenues recover quickly. Arise encourages state lawmakers to modernize and strengthen Alabama’s tax system to ensure it is both fair and adequate. One good step would be to eliminate the state deduction for federal income tax payments. Another would be to impose a temporary income surtax on millionaires.

These changes and others would generate the revenue needed to help struggling families and protect our schools during tough times. And they would be a needed investment in a brighter, more inclusive future for Alabama. Read our full list of recommendations here.