The halls of the Alabama State House had a new face this legislative session.

LaTrell Clifford Wood started as Alabama Arise’s hunger policy advocate in November. Since then, the Stillman College graduate has worked tirelessly to ensure Alabama’s most marginalized residents have access to food. In her role, she advocates directly with lawmakers for legislation that supports getting food to the Alabamians who need it most. She also convenes the Hunger Free Alabama coalition of 88 organizations.

As the youngest member of the Arise staff, LaTrell offered up insights after her first legislative session.

“I think this session has really taught me to hold space for the world to grow, change and evolve, and find new room for hope,” she said. “You can have a resume that is really heavy with blue collar and service experience, and those experiences are meaningful. Those are ‘real jobs.’”

The intergenerational relationships with other Arise staff members proved to be helpful as she navigated an especially challenging session.

The intergenerational relationships with other Arise staff members proved to be helpful as she navigated an especially challenging session.

“I picked up gems of wisdom from people who have been doing this work a lot longer than me, and actualized the value that young people can bring to a space when they are treated as meaningful contributors,” LaTrell said.

Making use of opportunities

LaTrell grew up in Irondale, a city of about 13,000 near Birmingham, and is a proud HBCU grad. Her time at Stillman brought her into hunger advocacy work and a systemic framework for change.

“There are systems in place by which we lose wisdom with the people we love. So I said to myself, ‘Whatever I do, I have to take care of myself, and it has to be sustainable,’” LaTrell said. “Since I was a pandemic grad, I decided to take a break and explore more options, and that led me to Congressional Black Caucus Foundation [CBCF].”

Through the CBCF, LaTrell interned in U.S. Rep. Terri Sewell’s office in Washington, D.C. That is where she first learned of Alabama Arise.

“My team in Rep. Sewell’s office really advocated for me, and Akiesha [Anderson, Arise’s former policy and advocacy director] really opened the doors for me to Alabama politics, and made a safe space for me to come back home and grow and learn at Arise, and I am so grateful for her and the rest of Arise’s staff for welcoming me,” LaTrell said.

Telling her story

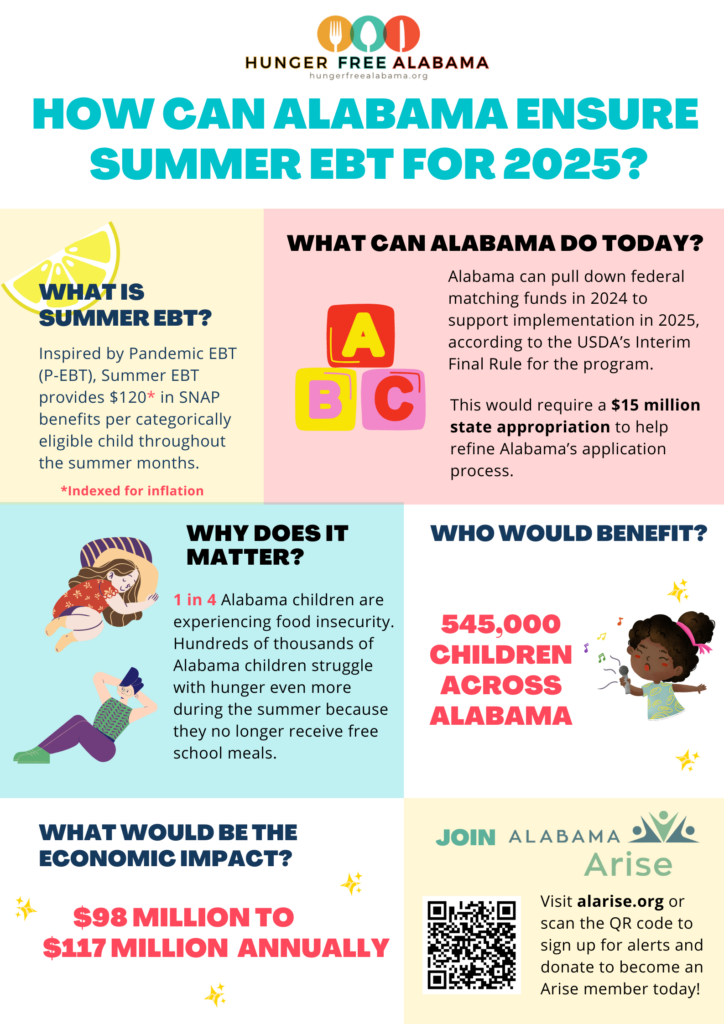

LaTrell’s advocacy this year helped secure $10 million in Summer EBT administrative funding for 2025. (See page 2.) She finds that telling her personal stories to lawmakers has helped her in this work.

“It was really healing and energizing to talk to Sen. [Rodger] Smitherman, whose district I grew up in, about my experiences with hunger and its impact, and see him really stand 10 toes down for children across the state,” she said. “Countless children will have some measure of relief from hunger over the summer months, for generations to come. It’s hard to wrap my head around in more ways than one.”

After an impactful first legislative session, LaTrell has even bigger goals for Arise’s hunger advocacy work. Universal school breakfast is her next advocacy priority.

“I think the first step in that is leaning into securing a state appropriation to subsidize universal school breakfast in the next year,” she said.

LaTrell also said she hopes to help bring even more young people like her into the Alabama Arise fold.

“I look forward to building more avenues to meet young Alabamians where they are,” she said.

An optimistic look at Alabama

As a young Alabamian who returned to the state after working elsewhere, LaTrell said she wants the rest of the world to see what Alabama is really like.

“When I go out of state, a lot of people say, ‘You’re from Alabama?’ And there’s always a tone,” she said. “So my favorite experience is being able to school people on all the misconceptions they have, and all the contributions Alabamians and Alabama have made to the U.S. and the world.”

LaTrell is incredibly proud of her Alabama roots and how they’ve shaped her family.

“My family has been domestic refugees of the state, run out by racial violence during the first wave of the Great Migration. But somehow, we find our way back, and every generation, we have been able to make a meaningful difference. And that is worth being proud of,” she said.

How to get involved

For those looking to get involved with the critical work of feeding Alabamians, LaTrell has some suggestions.

Arise supporters who live in or have connections in Limestone and Morgan counties, as well as Opelika, can support hunger advocacy by talking with parents, educators and superintendents in their communities about the Community Eligibility Provision (CEP). More than 50% of the schools in these areas could serve universal school meals through CEP but are not. The deadline for schools to opt in for the upcoming school year is June 30.

“I encourage members to keep an eye out for hunger-related action alerts, and follow us on Facebook at Hunger Free Alabama!” LaTrell said.