The sales tax may seem less visible than other taxes because we pay it in small bits, unlike once-a-year property and income tax payments. But in reality, the sales tax is the most regressive of Alabama’s three major state taxes (income, property and sales). It consumes a much greater portion of the household budget for families with low and middle incomes than it does for wealthier families.

Sales taxes on food and other necessities add to the financial strain facing families who struggle to make ends meet. Fortunately, Alabama’s new grocery tax reduction will help ease that strain and make our state’s tax system more just.

How the new law changes sales tax rates

Alabama’s state sales tax rate (4%) is lower than that of most states. But in addition to the state sales tax, people also must pay local sales taxes when shopping. When you add in local sales taxes, the combined Alabama sales tax rate – averaging 9% – is among the nation’s highest. Combined municipal, county and state sales taxes range from 7% in the Kansas community (in Walker County) to 12% in Ohatchee (in Calhoun County).

HB 479 reduced the state portion of the sales tax on food from 4% to 3%, effective Sept. 1, 2023. Another reduction to 2% will come in September 2024, or the first year afterward when education revenues grow by at least 3.5%. This means that in a locality with a 9% combined sales tax rate, the overall food tax is now 8%. That reduction will save Alabamians the equivalent of about half a week’s groceries each year.

The new law allows – but does not require – cities and counties to reduce their sales taxes on groceries. Most have not, citing the difficulty of securing other revenue sources due to limits on their ability to levy other local taxes imposed by the state constitution.

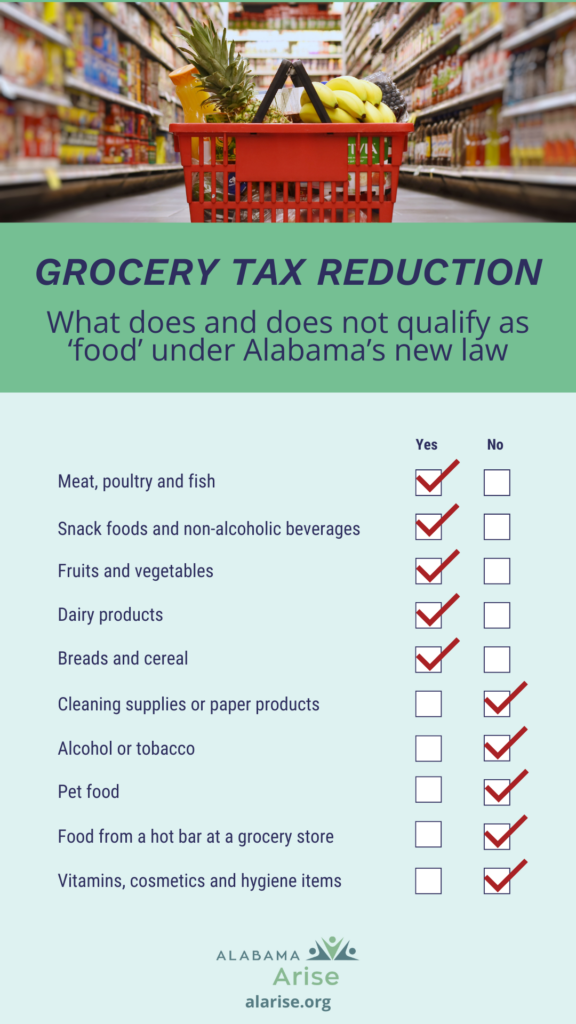

What does and does not qualify as ‘food’ under the law

The new law reduces the sales tax on “food,” defined as anything eligible to be purchased with benefits under the Supplemental Nutrition Assistance Program (SNAP). This federal definition of “food” does apply to a broad range of foods and drinks, including:

- Fruits and vegetables (fresh, frozen or canned)

- Meat, poultry and fish

- Dairy products

- Breads and cereal

- Snack foods and non-alcoholic beverages

However, not everything qualifies for the grocery tax reduction. It does not apply to prepared meals served at restaurants or to most other hot, precooked foods. And it does not apply to many other items commonly purchased in a grocery store or the grocery section of “big box” stores like Walmart, Costco or Target. Items taxed at the new, lower rate do not include:

- Foods that are purchased hot

- Household cleaning supplies or paper products

- Pet food

- Alcohol or tobacco

- Vitamins, cosmetics and hygiene items

Items not defined as “food” are still subject to the 4% state sales tax and the full local tax. This is true even if the items are sold at a grocery store or a retailer with a grocery section. Your receipts may show separate subtotals to reflect the different sales tax rates that apply to food and other items. (Look up your local sales tax rates here.)

What should happen next

Implementation of the grocery tax reduction ran into brief first-day hiccups at some stores, leading to some initial confusion. But one thing should be crystal clear and easy to understand: Reducing the sales tax on food will make life better for every Alabamian.

The new state grocery tax reduction will combat hunger and make it easier for Alabama families to afford food. And eventually eliminating the rest of the state grocery tax would help even more. Alabama Arise is committed to continue working to untax groceries responsibly and sustainably in future legislative sessions.